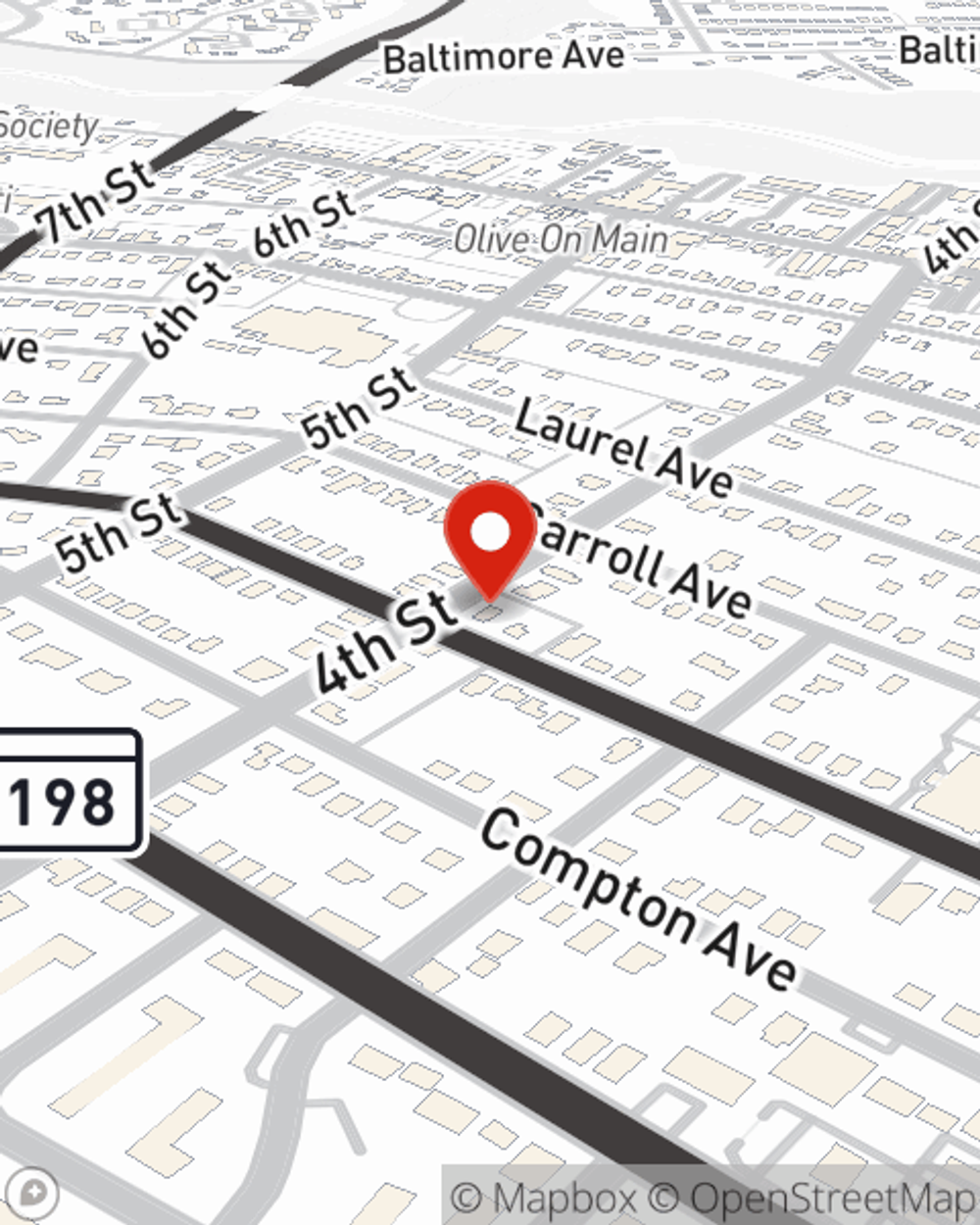

Condo Insurance in and around Laurel

Looking for excellent condo unitowners insurance in Laurel?

Protect your condo the smart way

Calling All Condo Unitowners!

Stepping into condo ownership is a big deal. You need to consider your future needs cosmetic fixes and more. But once you find the perfect condo to call home, you also need terrific insurance. Finding the right coverage can help your Laurel unit be a sweet place to call home!

Looking for excellent condo unitowners insurance in Laurel?

Protect your condo the smart way

Put Those Worries To Rest

With this protection from State Farm, you don't have to be afraid of the unexpected happening to your condo and its contents. Agent Kathy Fowler can help provide all the various options for you to consider, and will assist you in constructing a dependable policy that's right for you.

Laurel condo owners, are you ready to find out what a company that helps customers by handling thousands of claims each day can do for you? Visit State Farm Agent Kathy Fowler today.

Have More Questions About Condo Unitowners Insurance?

Call Kathy at (301) 369-0507 or visit our FAQ page.

Simple Insights®

Help protect your home and family with home security

Help protect your home and family with home security

Security and burglar alarms systems help deter burglars and protect your home. Learn more about monitored systems and security alarms.

What are the different types of insurance?

What are the different types of insurance?

You can have more coverage than just car insurance, homeowners insurance, and life insurance. Learn about options for these and other types of policies.

Kathy Fowler

State Farm® Insurance AgentSimple Insights®

Help protect your home and family with home security

Help protect your home and family with home security

Security and burglar alarms systems help deter burglars and protect your home. Learn more about monitored systems and security alarms.

What are the different types of insurance?

What are the different types of insurance?

You can have more coverage than just car insurance, homeowners insurance, and life insurance. Learn about options for these and other types of policies.